IIFT 2011 RC | Previous Year IIFT Paper

Read the following passage carefully and answer the questions given at the end

The second issue I want to address is one that comes up frequently - that Indian banks should aim to become global. Most people who put forward this view have not thought through the costs and benefits analytically; they only see this as an aspiration consistent with India’s growing international profile. In its 1998 report, the Narasimham (II) Committee envisaged a three tier structure for the Indian banking sector: 3 or 4 large banks having an international presence on the top, 8-10 mid-sized banks, with a network of branches throughout the country and engaged in universal banking, in the middle, and local banks and regional rural banks operating in smaller regions forming the bottom layer. However, the Indian banking system has not consolidated in the manner envisioned by the Narasimham Committee. The current structure is that India has 81 scheduled commercial banks of which 26 are public sector banks, 21 are private sector banks and 34 are foreign banks. Even a quick review would reveal that there is no segmentation in the banking structure along the lines of Narasimham II.

A natural sequel to this issue of the envisaged structure of the Indian banking system is the Reserve Bank’s position on bank consolidation. Our view on bank consolidation is that the process should be market-driven, based on profitability considerations and brought about through a process of mergers & amalgamations (M&As). The initiative for this has to come from the boards of the banks concerned which have to make a decision based on a judgment of the synergies involved in the business models and the compatibility of the business cultures. The Reserve Bank’s role in the reorganisation of the banking system will normally be only that of a facilitator.

lt should be noted though that bank consolidation through mergers is not always a totally benign option. On the positive side are a higher exposure threshold, international acceptance and recognition, improved risk management and improvement in financials due to economies of scale and scope. This can be achieved both through organic and inorganic growth. On the negative side, experience shows that consolidation would fail if there are no synergies in the business models and there is no compatibility in the business cultures and technology platforms of the merging banks.

Having given that broad brush position on bank consolidation let me address two specific questions:

(i) can Indian banks aspire to global size?; and (ii) should Indian banks aspire to global size?

On the first question, as per the current global league tables based on the size of assets, our largest bank, the State Bank of India (SBI), together with its subsidiaries, comes in at No.74 followed by ICICI Bank at No. I45 and Bank of Baroda at 188. It is, therefore, unlikely that any of our banks will jump into the top ten of the global league even after reasonable consolidation.

Then comes the next question of whether Indian banks should become global. Opinion on this is divided. Those who argue that we must go global contend that the issue is not so much the size of our banks in global rankings but of Indian banks having a strong enough, global presence. The main argument is that the increasing global size and influence of Indian corporates warrant a corresponding increase in the global footprint of Indian banks. The opposing view is that Indian banks should look inwards rather than outwards, focus their efforts on financial deepening at home rather than aspiring to global size.

It is possible to take a middle path and argue that looking outwards towards increased global presence and looking inwards towards deeper financial penetration are not mutually exclusive; it should be possible to aim for both. With the onset of the global financial crisis, there has definitely been a pause to the rapid expansion overseas of our banks. Nevertheless, notwithstanding the risks involved, it will be opportune for some of our larger banks to be looking out for opportunities for consolidation both organically and inorganically. They should look out more actively in regions which hold out a promise of attractive acquisitions.

The surmise, therefore, is that Indian banks should increase their global footprint opportunistically even if they do not get to the top of the league table.

Identify the correct statement from the following:

- A.

Large banks having an international presence should not be engaged in universal banking.

- B.

Some people expect all banks to become global in coming years, in line with globalization.

- C.

Indian banking system has not consolidated as was foreseen by the Narasimham Committee.

- D.

Reserve Bank of India envisages the role of a facilitator for itself in the direction of bank consolidation.

Answer: Option C

Explanation :

Option 1 contradicts paragraph 7.

Option 2 misconstrues what has been mentioned in paragraph 6.Option 3 has been mentioned in the first paragraph, “ … the Indian banking system has not consolidated in the manner envisioned by the Narasimham Committee.”Option 4 is incorrect, since it states that the Reserve bank of India envisages a role of facilitator ‘for itself’. In the second paragraph, the author mentions ‘our view’ on bank consolidation and merely states that “the Reserve Bank's role in the reorganization of the banking system will normally be only that of a facilitator.” There is nothing to indicate that this role has been envisaged by the RBI for itself.

Hence, the correct answer is option 3.

Workspace:

Identify the correct statement from the following:

- A.

Indian banks should not go for global inorganic expansion as there is no compatibility in business cultures.

- B.

Indian banks do not aspire to be global.

- C.

Indian banks cannot be global even after reasonable consolidation.

- D.

After the onset of the global financial crisis, some regions hold out a promise of attractive acquisitions for banks.

Answer: Option D

Explanation :

Option 1 with ‘should not go for global inorganic expansion’ is incorrect. Paragraph 3 explains the negative side to consolidation – that it may fail if there is no compatibility in the business cultures, among other reasons. However, it does not suggest that Indian banks should not go for global inorganic expansion.

There is nothing in the passage to support option 2.Option 3 with ‘cannot be global’ is too harsh, since the passage merely states that “it is unlikely that any of our banks will jump into the top ten of the global league even after reasonable consolidation.”Option 4 can be inferred from the last line of the penultimate paragraph.

Hence, the correct answer is option 4.

Workspace:

Identify the wrong statement from the following:

- A.

Bank consolidation through mergers increases the merged entity’s ability to take higher exposures.

- B.

There is still scope for Indian banks to expand internally.

- C.

None of the Indian banks presently are global.

- D.

Global financial crisis has increased the risks of overseas expansion.

Answer: Option C

Explanation :

Paragraph 3 states that one of the positive aspects to bank consolidation through mergers is a “higher exposure threshold”. Thus option 1 is true.

Paragraph 6 urges banks to “look inwards” and “focus on financial deepening at home”. This means that there is indeed scope to do so. Thus option 2 is also true.Option 3 is untrue, since paragraph 5 lists banks which fall under the current global league tables.Option 4 can be inferred from paragraph 7, which mentions the risks in relation to the pause in overseas expansion with the onset of the global crisis.

Hence the correct answer is option 3.

Workspace:

Read the following passage carefully and answer the questions given at the end

Before the internet, one of the most rapid changes to the global economy and trade was wrought by something so blatantly useful that it is hard to imagine a struggle to get it adopted: the shipping container. In the early 1960s, before the standard container became ubiquitous, freight costs were I0 per cent of the value of US imports, about the same barrier to trade as the average official government import tariff. Yet in a journey that went halfway round the world, half of those costs could be incurred in two ten-mile movements through the ports at either end. The predominant ‘break-bulk’ method, where each shipment was individually split up into loads that could be handled by a team of dockers, was vastly complex and labour-intensive. Ships could take weeks or months to load, as a huge variety of cargoes of different weights, shapes and sizes had to be stacked together by hand. Indeed, one of the most unreliable aspects of such a labour-intensive process was the labour. Ports, like mines, were frequently seething pits of industrial unrest. Irregular work on one side combined with what was often a tight-knit, well - organized labour community on the other.

In 1956, loading break-bulk cargo cost $5.83 per ton. The entrepreneurial genius who saw the possibilities for standardized container shipping, Malcolm McLean, floated his first containerized ship in that year and claimed to be able to shift cargo for 15.8 cents a ton. Boxes of the same size that could be loaded by crane and neatly stacked were much faster to load. Moreover, carrying cargo in a standard container would allow it to be shifted between truck, train and ship without having to be repacked each time.

But between McLean’s container and the standardization of the global market were an array of formidable obstacles. They began at home in the US with the official Interstate Commerce Commission, which could prevent price competition by setting rates for freight haulage by route and commodity, and the powerful International Longshoremen's Association (ILA) labour union. More broadly, the biggest hurdle was achieving what economists call ‘network effects’: the benefit of a standard technology rises exponentially as more people use it. To dominate world trade, containers had to be easily interchangeable between different shipping lines, ports, trucks and railcars. And to maximize efficiency, they all needed to be the same size. The adoption of a network technology often involves overcoming the resistance of those who are heavily invested in the old system. And while the efficiency gains are clear to see, there are very obvious losers as well as winners. For containerization, perhaps the most spectacular example was the demise of New York City as a port.

In the early I950s, New York handled a third of US seaborne trade in manufactured goods. But it was woefully inefficient, even with existing break-bulk technology: 283 piers, 98 of which were able to handle ocean-going ships, jutted out into the river from Brooklyn and Manhattan. Trucks bound‘ for the docks had to fiive through the crowded, narrow streets of Manhattan, wait for an hour or two before even entering a pier, and then undergo a laborious two-stage process in which the goods foot were fithr unloaded into a transit shed and then loaded onto a ship. ‘Public loader’ work gangs held exclusive rights to load and unload on a particular pier, a power in effect granted by the ILA, which enforced its monopoly with sabotage and violence against than competitors. The ILA fought ferociously against containerization, correctly foreseeing that it would destroy their privileged position as bandits controlling the mountain pass. On this occasion, bypassing them simply involved going across the river. A container port was built in New Jersey, where a 1500-foot wharf allowed ships to dock parallel to shore and containers to be lified on and off by crane. Between 1963 - 4 and 1975 - 6, the number of days worked by longshoremen in Manhattan went from 1.4 million to 127,041.

Containers rapidly captured the transatlantic market, and then the growing trade with Asia. The effect of containerization is hard to see immediately in freight rates, since the oil price hikes of the 1970s kept them high, but the speed with which shippers adopted; containerization made it clear it brought big benefits of efficiency and cost. The extraordinary growth of the Asian tiger economies of Singapore, Taiwan, Korea and Hong Kong, which based their development strategy on exports, was greatly helped by the container trade that quickly built up between the US and east Asia. Ocean-borne exports from South Korea were 2.9 million tons in 1969 and 6 million in 1973, and its exports to the US tripled.

But the new technology did not get adopted all on its own. It needed a couple of pushes from government - both, as it happens, largely to do with the military. As far as the ships were concerned, the same link between the merchant and military navy that had inspired the Navigation Acts in seventeenth-century England endured into twentieth-century America. The government's first helping hand was to give a spur to the system by adopting it to transport military cargo. The US armed forces, seeing the efficiency of the system, started contracting McLean’s company Pan-Atlantic, later renamed Sea-land, to carry equipment to the quarter of a million American soldiers stationed in Western Europe. One of the few benefits of America's misadventure in Vietnam was a rapid expansion of containerization. Because war involves massive movements of men and material, it is often armies that pioneer new techniques in supply chains.

The government’s other role was in banging heads together sufficiently to get all companies to accept the same size container. Standard sizes were essential to deliver the economies of scale that came from interchangeability - which, as far as the military was concerned, was vital if the ships had to be commandeered in case war broke out. This was a significant problem to overcome, not least because all the companies that had started using the container had settled on different sizes. Pan- Atlantic used 35-foot containers, because that was the maximum size allowed on the highways in its home base in New Jersey. Another of the big shipping companies, Matson Navigation, used a 24-foot container since its biggest trade was in canned pineapple from Hawaii, and a container bigger than that would have been too heavy for a crane to lift. Grace Line, which largely traded with Latin America, used a foot container that was easier to truck around winding mountain roads.

Establishing a US standard and then getting it adopted internationally took more than a decade. Indeed, not only did the US Maritime Administration have to mediate in these rivalries but also to fight its own turf battles with the American Standards Association, an agency set up by the private sector. The matter was settled by using the power of federal money: the Federal Maritime Board (FMB), which handed out to public subsidies for shipbuilding, decreed that only the 8 x 8-foot containers in the lengths of l0, 20, 30 or 40 feet would be eligible for handouts.

Identify the correct statement:

- A.

The freight costs accounted for around I0 per cent of the value of imports in general during early l960s, given the labour-intensive ‘break-bulk’ cargo handling.

- B.

As a result of growing adoption of containerized trade during 1969-73, while the ocean-borne exports from South Korea in general more than doubled, the same to the US tripled.

- C.

The outbreak of the Vietnam war functioned as a major positive force towards rapid expansion of containerization, as American imports from the country increased heavily.

- D.

In the early days of container trade development, a major shipping firm Matson Navigation used a 24-foot container since a bigger container was not suitable for its trucks.

Answer: Option B

Explanation :

Option 1 says "imports in general" rather than US imports. (Para 1)

Option 3 says "imports" rather than "moving equipment to Western Europe". (Para 6)Option 4 should have cranes instead of trucks. (Para 7)Option 2 is correct as given in Para 5.

Hence, the correct answer is option 2.

Workspace:

Identify the false statement:

- A.

In the pre-containerization days, trucks bound for the New York docks had to pass through the narrow streets, wait for an hour or two before even entering a pier, and then undergo a laborious three-stage process for loading onto a ship.

- B.

Once satisfied with the effectiveness of containerized trade, the US military engaged the company of Malcolm McLean to transport equipments for their soldiers stationed in Western Europe.

- C.

Cargo loading during 1960s usually took a long period, as it involved manual handling of huge variety of cargoes of different weights, shapes and sizes.

- D.

The issue of standardization of the containers created led to a debate .between the US government and American Standards Association, but the question was finally sorted through public subsidy programme by Federal Maritime Board.

Answer: Option A

Explanation :

Option 1 should say two-stage instead of three-stage. (Para 4).

The other options are correct based on the passage: option 2 (Para 6), option 3(Para 1), option 4 (Para 7)

Hence, the correct answer is option 1.

Workspace:

The emergence of containerization technology in early seventies resulted in:

- A.

Immediate adoption of the containerized export route by private companies, in their own accord.

- B.

An instant sharp reduction in freight costs expressed as a percentage of imports across countries.

- C.

Spectacular growth in exports from the East Asian tiger economies, which were reliant on an export-oriented growth strategy.

- D.

All of the above

Answer: Option C

Explanation :

The technology did not get adopted immediately, making option 1 incorrect. (Para 6)

Option 2 is the opposite of what is mentioned in Para 5 and the same paragraph support option 3.

Hence, the correct answer is option 3.

Workspace:

Match the following

- A.

a – i; b – iv, c – ii; d - iii

- B.

a – iii; b – i, c – iv; d - ii

- C.

a – iv; b – i, c – ii; d - iii

- D.

a – iii; b – iv, c – ii; d – i

Answer: Option D

Explanation :

Mclean's company Pan Atlantic was based in New Jersey. (d-i) (Para 6 and 7)

With this, the others options can be eliminated.Also, FMB (Federal Maritime Board) was responsible for standardization. (Para 7)And, Grace Line used 17-foot containers that were easier to truck around mountain roads. (Para 7)

Hence, the correct answer is option 4.

Workspace:

Read the following passage carefully and answer the questions given at the end.

I have tried to introduce into the discussion a number of attributes of consumer behaviour and motivations, which I believe are important inputs into devising a strategy for commercially viable financial inclusion. These related broadly to the (i) the sources of livelihood of the potential consumer segment for financial inclusion (ii) how they spend their money, particularly on non-regular items (iii) their choices and motivations with respect to saving and (iv) their motivations for borrowing and their ability to access institutional sources of finance for their basic requirements. In discussing each of these sets of issues, I spent some time drawing implications for business strategies by financial service providers. In this section, I will briefly highlight, at the risk of some repetition, what I consider to be the key messages of the lecture.

The first message emerges from the preliminary discussion on the current scenario on financial inclusion, both at the aggregate level and across income categories. The data suggest that even savings accounts, the most basic financial service, have low penetration amongst the lowest income households. I want to emphasize that we are not talking about Below Poverty Line households only; Rs. 50,000 per year in 2007, while perhaps not quite middle class, was certainly quite far above the official poverty line. The same concerns about lack of penetration amongst the lowest income group for loans also arise. To reiterate the question that arises from these data patterns: is this because people can’t access banks or other service providers or because they don’t see value in doing so? This question needs to be addressed if an effective inclusion strategy is to be developed.

The second message is that the process of financial inclusion is going to be incomplete and inadequate if it is measured only in terms of new accounts being opened and operated. From the employment and earning patterns, there emerged a sense that better access to various kinds of financial services would help to increase the livelihood potential of a number of occupational categories, which in turn would help reduce the income differentials between these and more regular, salaried jobs. The fact that a huge proportion of the Indian workforce is either self-employed and in the casual labour segment suggests the need for products that will make access to credit easier to the former, while offering opportunities for risk mitigation and consumption smoothing to the latter.

The third message emerges from the analysis of expenditure patterns is the significance of infrequent, but quantitatively significant expenditures like ceremonies and medical costs. Essentially, dealing with these kinds of expenditures requires either low-cost insurance options, supported by a correspondingly low-cost health care system or a low level systematic investment plan, which allows even poor households to create enough of a buffer to deal with these demands as and when they arise. As has already been pointed out, it is not as though such products are not being offered by domestic financial service providers. It is really a matter of extending them to make them accessible to a very large number of lower income households, with a low and possibly uncertain ability to maintain regular contributions.

The fourth message comes strongly from the motivations to both save and borrow, which, as one might reasonably expect, significantly overlap with each other. It is striking that the need to deal with emergencies, both financial and medical, plays such an important role in both sets of motivations. The latter is, as has been said, amenable to a low-cost, mass insurance scheme, with the attendant service provision. However, the former, which is a theme that recurs through the entire discussion on consumer characteristics, certainly suggests that the need for some kind of income and consumption smoothing product is a significant one in an effective financial inclusion agenda. This, of course, raises broader questions about the role of social safety nets, which offer at least some minimum income security and consumption smoothing. How extensive these mechanisms should be, how much security they should offer and for how long and how they should be financed are fundamental policy questions that go beyond the realm of the financial sector. However, to the extent that risk mitigation is a significant financial need, it must receive the attention of any meaningful financial inclusion strategy, in a way which provides practical answers to all these three questions.

The fifth and final message is actually the point I began the lecture with. It is the critical importance of the principle of commercial viability. Every aspect of a financial inclusion strategy — whether it is the design of products and services or the delivery mechanism — needs to be viewed in terms of the business opportunity that it offers and not as a deliverable that has been imposed on the service provider. However, it is also important to emphasize that commercial viability need not necessarily be viewed in terms of immediate cost and profitability calculations. Like in many other products, financial services also offer the prospect of a life-cycle model of marketing. Establishing a relationship with first-time consumers of financial products and services offers the opportunity to leverage this relationship into a wider set of financial transactions as at least some of these consumers move steadily up the income ladder. In fact, in a high growth scenario, a high proportion of such households are likely to move quite quickly from very basic financial services to more and more sophisticated ones. ln other words, the commercial viability and profitability of a financial inclusion strategy need not be viewed only from the perspective of immediacy. There is a viable investment dimension to it as well.

Which of the following statements is incorrect?

- A.

In order to succeed, financial inclusion has to be commercially viable.

- B.

Savings account is one of the basic vehicles for financial inclusion.

- C.

Savings accounts have low penetration amongst “Below Poverty Line” households only.

- D.

There is lack of penetration for loans amongst the lowest income group.

Answer: Option C

Explanation :

Option 3 is incorrect from the first few lines of Para 2. (Rs. 50,000 per year).

Options 1, 2 and 4 can be inferred from Paras 6, 2 and 3 respectively.

Hence, the correct answer is option 3.

Workspace:

Which of the following statements is correct?

- A.

Financial inclusion is exclusively measured in terms of new accounts being opened and operated.

- B.

There is a felt need for better access to credit products for the self-employed.

- C.

It is felt that financial inclusion could be profitable from day one if a commercially viable strategy is devised.

- D.

Financial Institutions must deliver social service through financial inclusion.

Answer: Option B

Explanation :

Option 1 is the opposite of what is stated in Para 3. Option 3 and 4 are different from what is stated in Para 6.

Option 2 is stated in Para 3.

Hence, the correct answer is option 2.

Workspace:

Identify the correct statement from the following:

- A.

Casual labour segment may not require risk mitigation products like insurance as their expenditures on consumption are high relative to their incomes.

- B.

Income of upto Rs. 60,000 per year is the benchmark for official Poverty Line.

- C.

Financial sector should also look into their role of broadening social safety nets.

- D.

Risk mitigation of casual labour must receive attention in any meaningful financial inclusion strategy.

Answer: Option D

Explanation :

Options 1, 2 and 3 are different from what is stated in Para 5, 2 and 5 respectively.

Option 4 is correct from Para 5.

Hence, the correct answer is option 4.

Workspace:

Identify the wrong statement from the following:

- A.

High expenditures on ceremonies and medical costs can be met through a low - level Systematic Investment Plan.

- B.

Given the high growth scenario of the country, only few of the consumers are expected to move up the income ladder.

- C.

Financial and medical emergencies motivate one to save and borrow.

- D.

There is an opportunity for banks to cross-sell their products to the bottom of the pyramid.

Answer: Option B

Explanation :

Options 1 and 3 find support from Para 5. Option 4 finds support from Para 6. Option 4 should have many instead of few (Para 6).

Hence, the correct answer is option 2.

Workspace:

Read the following passage carefully and answer the questions given at the end

When Ratan Tata moved the Supreme Court, claiming his right to privacy had been violated, he called Harish Salve. The choice was not surprising. The former solicitor general had been topping the legal charts ever since he scripted a surprising win for Mukesh Ambani against his brother Anil. That dispute set the gold standard for legal fees. On Mukesh’s side were Salve, Rohinton Nariman, and Abhishek Manu Singhvi. The younger brother had an equally formidable line-up led by Ram Jethmalani and Mukul Rohatgi.

The dispute dated back three-and-a-half years to when Anil filed case against his brother for reneging on an agreement to supply 28 million cubic metres of gas per day from its Krishna-Godavari basin fields at a rate of $ 2.34 for 17 years. The average legal fee was Rs. 25 lakh for a full day's appearance, not to mention the overnight stays at Mumbai's five-star suites, business class travel, and on occasion, use of the private jet. Little wonder though that Salve agreed to take on Tata’s case pro bono. He could afford philanthropy with one of India’s wealthiest tycoons.

The lawyers’ fees alone, at a conservative estimate, must have cost the Ambanis at least Rs. 15 crore each. Both the brothers had booked their legal teams in the same hotel, first the Oberoi and, after the 26/ ll Mumbai attacks, the Trident. lt’s not the essentials as much as the frills that raise eyebrows. The veteran Jethmalani is surprisingly the most modest in his fees since he does not charge rates according to the strength of the client's purse. But as the crises have multiplied, lawyers‘fees have exploded.

The 50 court hearings in the Haldia Petrochemicals vs. the West Bengal Government cost the former a total of Rs. 25 crore in lawyer fees and the 20 hearings in the Bombay Mill Case, which dragged on for three years, cost the mill owners almost Rs. 10 crore. Large corporate firms, which engage star counsels on behalf of the client, also need to know their quirks. For instance, Salve will only accept the first brief. He will never be the second counsel in a case. Some lawyers prefer to be paid partly in cash but the best are content with cheques. Some expect the client not to blink while picking up a dinner tab of Rs. 1.75 lakh at a Chennai five star. A lawyer is known to carry his home linen and curtains with him while travelling on work. A firm may even have to pick up a hot Vertu phone of the moment or a Jaeger-LeCoutre watch of the hour to keep a lawyer in good humour.

Some are even paid to not appear at all for the other side - Aryama Sundaram was retained by Anil Ambani in the gas feud but he did not fight the case. Or take Raytheon when it was fighting the Jindals. Raytheon had paid seven top lawyers a retainer fee of Rs. 2.5 lakh each just to ensure that the Jindals would not be able to make a proper case on a taxation issue. They miscalculated when a star lawyer fought the case at the last minute. “I don’t take negative retainers”, shrugs Rohatgi, former additional solicitor general. “ALawyer’s job is to appear for any client that comes to him. lt’s not for the lawyers to judge if a client is good or bad but the court”. Indeed. He is, after all, the lawyer who argued so famously in court that B. Ramalinga Raju did not ‘fudge any account in the Satyam Case. All he did was “window dressing”.

Some high profile cases have continued for years, providing a steady source of income, from the Scindia succession battle which dates to 1989, to the JetLite Sahara battle now in taxation arbitration to the BCCI which is currently in litigation with Lalit Modi, Rajasthan Royals and Kings XI Punjab.

Think of the large law firms as the big Hollywood studios and the senior counsel as the superstar. There are a few familiar faces to be found in most of the big ticket cases, whether it is the Ambani gas case, Vodafone taxation or Bombay Mills case. Explains Salve, “There is a reason why we have more than one senior advocate on a case. When you're arguing, he’s reading the court. He picks up a point or a vibe that you may have missed.” Says Rajan Karanjawala, whose firm has prepared the briefs for cases ranging from the Tata's recent right to privacy case to Karisma Kapoor’s divorce, “The four jewels in the crown today are Salve, Rohatgi, Rohinton Nariman and Singhvi. They have replaced the old guard of Fali Nariman, Soli Sorabjee, Ashok Desai and K.K. Venugopal.” He adds, “The one person who defies the generational gap is Jethmalani who was India's leading criminal lawyer in the 1960s and is so today.”

The demand for superstar lawyers has far outstripped the supply. So a one-man show by, say, Rohatgi can run up billings of Rs. 40 crore, the same as a mid-sized corporate law firm like Titus and Co that employs 28 juniors. The big law filik such as AZB or Amarchand & Mangaldas or Luthra & Luthra have to do all the groundwork for the counsel, from humouring the clerk to ensure the A-lister turns up on the hearing day to sourcing appropriate foreign judgments in emerging areas such as environmental and patent laws. “We are partners in this. There are so few lawyers and so many matters,” points out Diljeet Titus.

As the trust between individuals has broken down, governments have questioned corporates and corporates are questioning each other, and an array of new issues has come up. The courts have become stronger. “The lawyer,” says Sundaram, with the flourish that has seen him pick up many Dhurandhares and Senakas at pricey art auctions, “has emerged as the modern day purohit.” Each purohit is head priest of a particular style. Says Karanjawala, “Harish is the closest example in today's bar to Fali Nariman; Rohinton has the best law library in his brain; Mukul is easily India's busiest lawyer while Manu Singhvi is the greatest multi-tasker.” Salve has managed a fine balancing act where he has represented Mulayam Singh Yadav and Mayawati, Parkash Singh Badal and Amarinder Singh, Lalit Modi and Subhash Chandra and even the Ambani brothers, of course in different cases. Jethmalani is the man to call for anyone in trouble. In judicial circles he is known as the first resort for the last resort. Even Jethmalani’s junior Satish Maneshinde, who came to Mumbai in I993 as a penniless law graduate from Karnataka, shot to fame (and wealth) after he got bail for Sanjay Dutt in 1996. Now he owns a plush office in Worli and has become a one-stop shop for celebrities in trouble.

Which of the following is not true about Ram Jethmalani?

- A.

In judicial circles, he is known as the first resort for the last resort

- B.

He is the most modest in his fees

- C.

He has been India’s leading criminal lawyer since 1960s

- D.

None of his juniors have done well in their careers

Answer: Option D

Explanation :

Option 1, 2 and 3 are mentioned in Paras 9, 3 and 7 respectively. Option 4 is the opposite of what is mentioned in Para 9.

Hence, the correct answer is option 4.

Workspace:

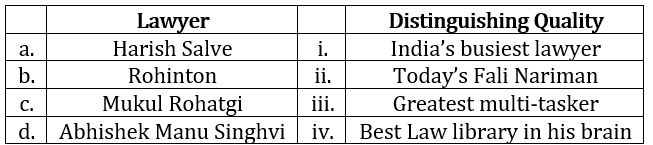

Match the following:

- A.

a-ii; b-iii; c-iv; d-i

- B.

a-ii; b-iv; c-i; d-iii

- C.

a-iii; b-iv; c-i; d-ii

- D.

a-iii; b-ii; c-iv; d-i

Answer: Option B

Explanation :

This match the column is based on the last para.

Hence, the correct answer is option 2.

Workspace:

What does a ‘negative retainer’ refer to?

- A.

Giving a lawyer only his fees and not the frills

- B.

Paying a lawyer to not fight a case for the other side

- C.

Having more than one senior advocate on a case

- D.

Reimbursing law firms for doing groundwork for the counsel

Answer: Option B

Explanation :

The answer is found in Para 5: paying someone to not fight a case for the other side.

Hence, the correct answer is option 2.

Workspace:

What does the phrase ‘pro bono’ mean?

- A.

Charged according to the client’s purse

- B.

Done without compensation for the public good

- C.

Carried out in the prescribed form

- D.

Taken up from the beginning

Answer: Option B

Explanation :

Option 2 is the correct meaning of pro bono.

Hence, the correct answer is option 2.

Workspace:

Read the following passage carefully and answer the questions given at the end.

The second issue I want to address is one that comes up frequently - that Indian banks should aim to become global. Most people who put forward this view have not thought through the costs and benefits analytically; they only see this as an aspiration consistent with India’s growing international profile. In its 1998 report, the Narasimham (II) Committee envisaged a three tier structure for the Indian banking sector: 3 or 4 large banks having an international presence on the top, 8-10 mid-sized banks, with a network of branches throughout the country and engaged in universal banking, in the middle, and local banks and regional rural banks operating in smaller regions forming the bottom layer. However, the Indian banking system has not consolidated in the manner envisioned by the Narasimham Committee. The current structure is that India has 81 scheduled commercial banks of which 26 are public sector banks, 21 are private sector banks and 34 are foreign banks. Even a quick review would reveal that there is no segmentation in the banking structure along the lines of Narasimham II.

A natural sequel to this issue of the envisaged structure of the Indian banking system is the Reserve Bank’s position on bank consolidation. Our view on bank consolidation is that the process should be market-driven, based on profitability considerations and brought about through a process of mergers & amalgamations (M&As). The initiative for this has to come from the boards of the banks concerned which have to make a decision based on a judgment of the synergies involved in the business models and the compatibility of the business cultures. The Reserve Bank’s role in the reorganisation of the banking system will normally be only that of a facilitator.

lt should be noted though that bank consolidation through mergers is not always a totally benign option. On the positive side are a higher exposure threshold, international acceptance and recognition, improved risk management and improvement in financials due to economies of scale and scope. This can be achieved both through organic and inorganic growth. On the negative side, experience shows that consolidation would fail if there are no synergies in the business models and there is no compatibility in the business cultures and technology platforms of the merging banks.

Having given that broad brush position on bank consolidation let me address two specific questions:

(i) can Indian banks aspire to global size?; and (ii) should Indian banks aspire to global size?

On the first question, as per the current global league tables based on the size of assets, our largest bank, the State Bank of India (SBI), together with its subsidiaries, comes in at No.74 followed by ICICI Bank at No. I45 and Bank of Baroda at 188. It is, therefore, unlikely that any of our banks will jump into the top ten of the global league even after reasonable consolidation.

Then comes the next question of whether Indian banks should become global. Opinion on this is divided. Those who argue that we must go global contend that the issue is not so much the size of our banks in global rankings but of Indian banks having a strong enough, global presence. The main argument is that the increasing global size and influence of Indian corporates warrant a corresponding increase in the global footprint of Indian banks. The opposing view is that Indian banks should look inwards rather than outwards, focus their efforts on financial deepening at home rather than aspiring to global size.

It is possible to take a middle path and argue that looking outwards towards increased global presence and looking inwards towards deeper financial penetration are not mutually exclusive; it should be possible to aim for both. With the onset of the global financial crisis, there has definitely been a pause to the rapid expansion overseas of our banks. Nevertheless, notwithstanding the risks involved, it will be opportune for some of our larger banks to be looking out for opportunities for consolidation both organically and inorganically. They should look out more actively in regions which hold out a promise of attractive acquisitions.

The surmise, therefore, is that Indian banks should increase their global footprint opportunistically even if they do not get to the top of the league table.

Identify the correct statement from the following:

- A.

Large banks having an international presence should not be engaged in universal banking.

- B.

Some people expect all banks to become global in coming years, in line with globalization.

- C.

Indian banking system has not consolidated as was foreseen by the Narasimham Committee.

- D.

Reserve Bank of India envisages the role of a facilitator for itself in the direction of bank consolidation.

Answer: Option C

Explanation :

Option 1 contradicts paragraph 7.

Option 2 misconstrues what has been mentioned in paragraph 6.Option 3 has been mentioned in the first paragraph, “ … the Indian banking system has not consolidated in the manner envisioned by the Narasimham Committee.”Option 4 is incorrect, since it states that the Reserve bank of India envisages a role of facilitator ‘for itself’. In the second paragraph, the author mentions ‘our view’ on bank consolidation and merely states that “the Reserve Bank's role in the reorganization of the banking system will normally be only that of a facilitator.” There is nothing to indicate that this role has been envisaged by the RBI for itself.

Hence, the correct answer is option 3.

Workspace:

Identify the correct statement from the following:

- A.

Indian banks should not go for global inorganic expansion as there is no compatibility in business cultures.

- B.

Indian banks do not aspire to be global.

- C.

Indian banks cannot be global even after reasonable consolidation.

- D.

After the onset of the global financial crisis, some regions hold out a promise of attractive acquisitions for banks.

Answer: Option D

Explanation :

Option 1 with ‘should not go for global inorganic expansion’ is incorrect. Paragraph 3 explains the negative side to consolidation – that it may fail if there is no compatibility in the business cultures, among other reasons. However, it does not suggest that Indian banks should not go for global inorganic expansion.

There is nothing in the passage to support option 2.Option 3 with ‘cannot be global’ is too harsh, since the passage merely states that “it is unlikely that any of our banks will jump into the top ten of the global league even after reasonable consolidation.”Option 4 can be inferred from the last line of the penultimate paragraph.

Hence, the correct answer is option 4.

Workspace:

Identify the wrong statement from the following:

- A.

Bank consolidation through mergers increases the merged entity’s ability to take higher exposures.

- B.

There is still scope for Indian banks to expand internally.

- C.

None of the Indian banks presently are global.

- D.

Global financial crisis has increased the risks of overseas expansion.

Answer: Option C

Explanation :

Paragraph 3 states that one of the positive aspects to bank consolidation through mergers is a “higher exposure threshold”. Thus option 1 is true.

Paragraph 6 urges banks to “look inwards” and “focus on financial deepening at home”. This means that there is indeed scope to do so. Thus option 2 is also true.Option 3 is untrue, since paragraph 5 lists banks which fall under the current global league tables.Option 4 can be inferred from paragraph 7, which mentions the risks in relation to the pause in overseas expansion with the onset of the global crisis.

Hence the correct answer is option 3.

Workspace:

Feedback

Help us build a Free and Comprehensive Preparation portal for various competitive exams by providing us your valuable feedback about Apti4All and how it can be improved.

Solution

Solution Discuss

Discuss Report

Report